Dear Clients, Colleagues, Partners, & Friends,

It’s hard to believe that this is my sixth annual letter as your CEO of Serhant Technologies.

In 2025, we grew 80% YTD, completely organically. We planted our flag in six new states and closed $6.5 billion in sales volume (and counting, the year’s not over yet!). We launched the AI app heard all over the real estate world, S.MPLE. We expanded Sellit.com, released season 2 of Owning Manhattan on Netflix, and more. All without - as you know - buying even $1 of revenue.

All of these accomplishments happened during the worst stretch for U.S. real estate sales volume in over 30 years. But the tide is turning on that front (read on to learn why). Imagine what we will achieve when we’re actually operating in a robust market!

The AI future is here and it’s reshaping everything around us. Economies. Our collective intelligence. How we live. The world as we know it. AI infrastructure is singlehandedly buoying entire nations’ economies (including our own), while its energy footprint exceeds the annual usage of entire countries. At the same time, political division, controversial fiscal policies, geopolitical tension, and climate shifts are creating an increasingly complex world to navigate.

Our journey to ‘Mission 2030’ demands that we confront it all. Because we always see opportunity and promise where others do not and we wake up each morning with a simple imperative: Be limitless. A new world is emerging, with new customs, new leaders, and new ways to dominate. We are exactly where we need to be - at exactly the right moment - to lead our industry forward.

Recently, I was rewatching one of my favorite movies of all time while getting to inbox zero, Forrest Gump. When I heard this quote, I thought, “He’s describing SERHANT.!”:

“... I just kept on going. I ran clear to the ocean. And when I got there, I figured, since I’d gone this far, I might as well turn around, just keep on going. When I got to another ocean, I figured, since I’d gone this far, I might as well just turn back, keep right on going.” – Forrest Gump

SERHANT. was born in 2020, in the middle of a global pandemic, with the world frozen in uncertainty. In 2021, we strengthened internal infrastructure and laid the groundwork for something unstoppable. By 2022, we made the industry stop and take notice with our explosive growth and fresh perspective. In 2023, we broke into new markets and proved that limits are meant to be shattered. 2024 saw us go all in with S.MPLE, gain unrivaled influence with our hit show on Netflix, and raise $45 million in VC funding. And this year, in 2025, we turned up the intensity with SCALE while breaking records and defining what it means to be at the nexus of media, technology, and real estate. We reached one ocean, then another. And in 2026, we’ll keep right on going.

We will double our market presence, recruit the best and brightest talent in every new location, and equip them with the tools to outperform anything the industry has ever seen. We have proven that we can ride any wave, outpace the market in sales and revenue, and transform every challenge into fuel for our next level of industry-defining dominance. I predict the next two years will be the busiest on record, and I cannot wait to show the world exactly what we’re capable of.

If you’re reading this, you likely know that I love to talk about ‘Brokerage 3.0.’ But now it’s time to go bigger, because SERHANT. is ‘Brokerage 3.0’. When we launched this company, our mission was clear: build the world's most human real estate company, where technology feels like hospitality and every system feels like support. Our goal was to give agents a sense of belonging and belief, along with the tools to be unstoppable. Today, S.MPLE empowers our agents to spend less time behind a screen and more time achieving results in the field. Our agents are seeing measurable results TODAY, not in some distant future. And we’re not done. We are building out functionality that will shock the market, rewrite the rules of real estate, and raise the bar for what it means to earn the trust of agents and clients.

You already know what to expect in the (many) pages that follow. I’ve done a deep dive into the economy, the administration’s impact on real estate, the housing market, industry trends, and a detailed SERHANT. business update. Skip ahead to the topics that interest you, or set aside some time and take it all in at once. The web version of this letter is hyperlinked by section at the top of the page for easy navigation.

Your trust, your support, and your energy drives us, pushes us, and powers everything SERHANT. stands for. We couldn’t do this without you. Thank you. And make no mistake, the best is still ahead. Until next year.

— Ryan

U.S. Economy Update

The 2025 economy is a jumble of contradictions abound and everyone is asking what comes next. On the positive side, there is an unprecedented amount of cash on the sidelines, ready to be deployed when and if the moment is right. The stock market soared to all-time highs in October, and despite recent moderation, wealth creation has been undeniably impressive this year. Our GDP is healthy, shaking off rising price pressures. But here’s where things get complicated: The Trump Administration renewed a 2017 tax cut package that saves Americans on their tax bills but also adds significantly to the national debt. The Fed is lowering rates, but it’s also been quick to throw cold water on any expected rate cuts that the market shows too much excitement about. Anxiety is high, and consumer sentiment is low. I’ll explore the health of the consumer below, but in short, when you look under the hood of our seemingly strong economy, some cracks indicate risk that shouldn’t be ignored.

Since the 2008 crash, the U.S. economy has been fueled by various stimulus measures, including artificially low interest rates, direct payments to consumers, bailout and grant packages, and more. These stimulus measures are inflationary, have disrupted the natural economic cycle, and have contributed to the ballooning of our national debt. Recessions are a healthy part of any economy; they spawn innovation and reset prices and productivity, but they’re becoming increasingly rare. Still, what goes up must come down, and now we must restore health to the parts of the economy that are struggling or continue to kick the can down the road until we reach a dead end.

This all sounds gloomy, but it’s not; in fact, my perspective is that millions of Americans have achieved incredible wealth in the last 5 years, thanks to a stock market on steroids and astronomical home equity growth, insulating them from the worst impacts of a future correction. We’re also at the dawn of an era of staggering prosperity and innovation unlike the world has ever seen. However, I’m realistic that some things will need to break to build that future, and the more prepared we are individually and collectively, the more we can diminish fear and empower action so we can all reap the rewards.

To illustrate my point, I’ve compiled my thoughts and research on the most impactful elements of our current economic reality. Let’s get into it…

U.S. Fiscal Policy

Here’s the quandary: America is addicted to cheap money, entitlement programs, and low taxes. I say this not to shift blame onto consumers, but to highlight the fiscal-policy catch-22 our nation continually faces. An administration that campaigned on high taxes and painful reform of Social Security and Medicare would never get elected. Those measures, however, are what it would take to resolve our deficit. Instead, our national debt continues to grow to unfathomable heights, a pressure that tightens household balance sheets and ultimately weakens the U.S. economy… Speaking of kicking the can down the road.

Cue the current fiscal picture in the U.S. The current administration is embroiled in battles on multiple fronts as it seeks to generate additional revenue through hotly contested tariffs (which may or may not be legal or effective) and put pressure on the Fed (which relies on political independence for its efficacy) to lower interest rates, thereby making our national debt payments cheaper. Both strategies, if implemented, would be inflationary at a time when U.S. consumers are already struggling with high prices after years of stubborn inflation and the Fed’s higher interest rates aimed at combating it.

The Fed has a dual mandate to maintain full employment in the U.S. while keeping inflation steady at 2%. However, as I mentioned, it relies on independence from political pressure for its fiscal toolkit to be effective. That political independence is at risk. The Fed continues to pursue its two-fold mission but faces challenges on several fronts, including a steepened yield curve, sticky inflation, an elevated fiscal deficit, and unprecedented political pressure; all of which detract from the Fed’s inherent purpose: to influence the health of the economy.

Last year, it seemed as though the Fed had successfully delivered the country out of the financial implications of the Covid era including its resulting inflation, through a so-called ‘soft landing,’ bringing inflation down from 40-year highs to near its 2% target without triggering unhealthy unemployment levels. It did so by raising rates from unsustainable and stimulating lows to two-decade highs that shocked the system. This froze the housing market, but consumer spending and businesses remained strong, thanks mostly to the stock market's incredible strength over the same period. Now, due to this strength, the higher interest rate environment, and the impacts of tariffs, inflation has risen modestly again, and the employment picture is beginning to falter.

As for the administration, they can undoubtedly be credited with getting creative (if sometimes contradictory) about generating revenue and trimming expenses. Now, the administration is on a mission to confront the high cost of living. To what effect, and at what cost to Americans, especially the poorest, remains to be seen.

Health of the Consumer

Since the Covid crash in 2020, we’ve all heard talk about the K-shaped recovery, a paradigm that describes a recovery for some (individuals, industries) and not for others. Recently, the post-COVID economic recovery has been expressed as a Jenga tower, a top-heavy Jenga tower, where the whole tower becomes increasingly weak as the bottom and middle sections become precarious, threatening to bring down the sturdy top along with the whole structure. According to a recent analysis by Moody’s, the top 10% of earners, those making around $200k/year or more, account for over half of total consumer spending in the U.S. Mark Zandi, chief economist for Moody’s Analytics, explains the risk: “It makes the economy highly vulnerable if anything goes off the rails for those high-income, high-net-worth households” [Bloomberg]. As for the bottom 90%, they’re feeling very bleak about the economy, beleaguered by a tough job market, slow income growth, rising prices, and rapidly rising debt.

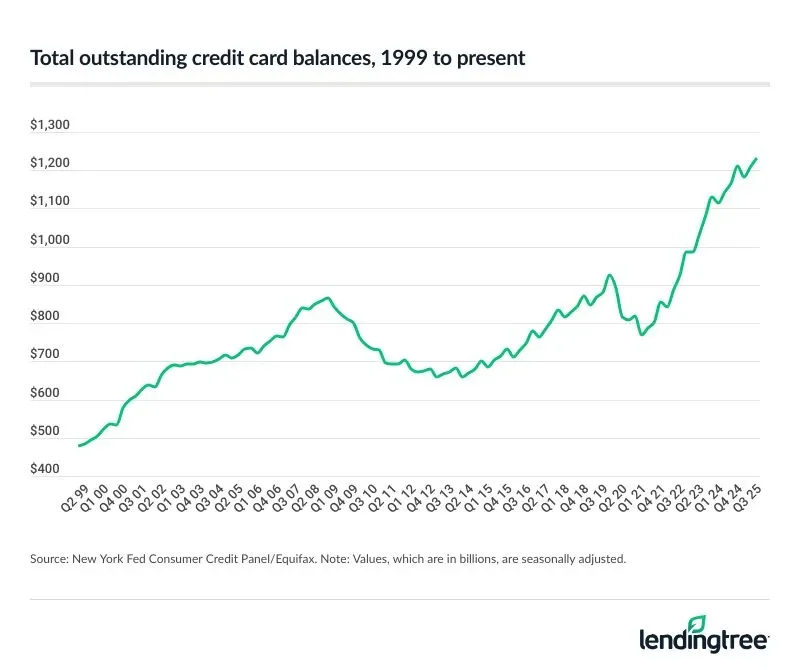

About that debt… Both personal credit card and student loan debt are at all-time highs, with student loan default rates higher than ever, and credit card delinquencies at levels not seen since the recovery from the Great Recession (see charts below).

Source: Macromicro

Causing and compounding the household debt and delinquency issue are a falling personal savings rate, slowing income growth, and a troubled labor market. As you’d expect, elevated delinquency rates on credit cards, student loans, and auto loans point to weaker spending on the horizon [Deloitte].

Several factors are amplifying the anticipated reduction in consumer spending. In their baseline scenario for the near future, Deloitte forecasts that:

[...] high tariffs become more evident in consumer prices, raising the core personal consumption expenditures price index to 3.3% in 2026, up from 2.8% in 2024, despite higher inflation, wage growth moderates, eroding purchasing power and consumer spending. In addition, weaker population growth from a sharp drop in net migration weighs on aggregate consumer spending. As a result, real consumer spending slows to 1.4% in 2026, down from an anticipated 2.1% in 2025. The unemployment rate rises to 4.5% in 2026, up from 4% in 2024 [Deloitte].

When you put all of this data in context, it becomes evident that the picture for the economy is precarious, á la the aforementioned Jenga tower analogy. There’s plenty of talk about where a crisis that starts at the top could originate; I’ll talk more about that in the following sections. But what happens to the Jenga tower if credit card and student loan borrowers default en masse? Could that be the source of our next recession? Is it possible we’re ignoring what’s right under our noses, distracted by a sexier source of a crash?

Investment Markets

There’s one word to describe the state of investment markets overall, and you’ll read it in every major publication right now: Frothy. How do we define froth in an economic sense? Exuberant. Overhyped. SPECULATIVE. And when we start using the “S” word (no, not that S. word), people get worried, and when people get worried, markets get volatile. In a piece I wrote earlier this year, I called the fundamentals “wonky,” and I stand by that characterization. Allow me to dissect why:

Stocks

Late in October 2025, all four U.S. stock market indexes closed at all-time highs. The same thing happened in September. That’s not normal. Stocks in AI and related categories are outperforming the rest, with the Mag 7 making up 30-40% of the S&P 500. This strength is primarily (OK, almost entirely) driven by AI. In fact, the S&P 500 is up around 16% YTD, but if you remove the Mag 7’s double-digit quarterly net income growth from the S&P 500, the remaining S&P 493 have actually recorded a cumulative, if modest, loss this year.

Regardless of the imbalance, this year’s stock market gains contributed in large part to household net worth ballooning to a new record-high of $176 trillion, aiding in persistent consumer spending, especially by the wealthiest 10% of Americans. That faction of the population is propping up our economy, as discussed in the Health of the Consumer section above. So what happens if one or more of the Mag 7 falters?

Lately, investors are getting a little nervous about just that. When do the AI firms turn a profit? Are we overbuilding the data centers? Can AI really do what they say it can? Even the AI companies themselves are admitting that they’re overvalued. Cue the bubble narrative.

We’re starting to see some movement towards investment safe havens, indicating that the nervousness is more than just chatter - but it’s far from a panic sale event. YoY stock gains are still extremely handsome in the face of headwinds. There is no crisis, at least not yet.

Treasury Bonds

Although bonds and stocks typically move in opposite directions, both markets are currently strong, but are seeing some tumultuous behavior. While bond yields are off their highs of nearly 5% seen at the beginning of this year, they’re still holding tight above post-Great Recession averages at over 4%, indicating investors still see risk. That being said, the yield curve finally un-inverted late last year and has steepened throughout 2025.

The bond market is not without its conflicts, facing various market conditions pulling demand in different directions. Whether the Fed continues to lower rates, whether the government shuts down again in January, whether the AI “bubble” gets bubblier, whether tariffs continue, and what happens in the labor market, all of which are up in the air right now, will determine what happens next in the bond market as investors weigh inflation concerns against hopes for easing monetary policy.

***Because I’m the CEO of a real estate company, I have to mention that mortgage interest rates are very closely tied to 10-year bond yields, and have a long-term average spread of about 1.7 percentage points. The current spread is higher at around 2.2 percentage points, and bond yields have been elevated in the face of an economy that could be characterized as too resilient since 2022. It’s clear that rates need to fall below their recent lows (in the mid-to-low 6% range), but the overall economy will have to slow to make that happen. Economists are not predicting yields to dip low enough to bring mortgage rates to that level, yet. I hate to hope for a problem, but I do see signs that the economy could cool more quickly than anticipated, which would lend itself to lower mortgage rates sooner than otherwise expected. From a real estate perspective, that problem would actually spawn some solutions in the form of relief to homebuyers and locked-in homeowners alike.

Precious Metals

YTD, Gold is up over 60%, silver is up over 111%, platinum is up over 84%, and palladium is up almost 67%. All have hit all-time highs at breakneck speed this year. Precious metals are safety bets, so, why are they surging when the stock market has performed so well? It seems the rally started with central bank buying, and some movement from risk-averse investors as economic and political uncertainty and AI bubble concerns started circulating, and then… It seems to have just gained momentum from traders following trends. Sounds like froth to me.

It would be unwise to chalk up this sort of rally in a safe-haven asset as incidental, though. Big demand for gold isn’t innocuous in my book.

Crypto

If you know me at all, you know I’m a crypto enthusiast. And let me tell you moments like this hit hard. A mere six weeks after Bitcoin hit its record high of over $126,000, it plummeted over 26%, erasing all of its 2025 gains. Both selling pressure from long-term holders cashing in and buy-side stalls due to macroeconomic concerns combined to drag the price down. The result? A loss of $600B in value according to CoinMarketCap data. That’s just Bitcoin; when you factor in other cryptocurrencies, about $1.2 trillion has been wiped off the total market value of all cryptocurrencies.

So Bitcoin is back under $100k, which was a major benchmark for the currency's success, and one I shouted from the rooftops in last year's annual letter, as it reached that threshold just before publishing in December. This is not a great moment for high-risk assets like Bitcoin, which spent 2025 gaining legitimacy through new trading mechanisms, a favorable regulatory environment, and widespread adoption. Despite the current strain, mark my words: I am still a crypto diehard. While I acknowledge that some of the intrigue and cool factor have worn off due to institutionalization, the groundwork is laid for crypto, especially Bitcoin, to accomplish the mission for it to democratize financial access worldwide. Is it acting less like digital gold and more like normal risk assets these days? Yes. But I don’t feel that that defeats the intended purpose.

Stablecoins gained legitimacy this year, now rivaling Visa and PayPal in annual transactions. ETFs have had less than 12 months to become established in ordinary portfolios. Traditional institutions are now offering crypto products directly to consumers. DeFi and FinTech use cases are still proliferating. Losses bounced back after the dip in April when tariff announcements did a number on all markets. All of this occurred against a backdrop of complicated macroeconomic forces. Between headwinds and growing pains, the volatility makes sense. We are entering a ‘maturity era’ of crypto that should lead to less volatility and more persistent, stable growth. Maybe I’ll eat my words, but I’m still betting on a rebound in the near-term.

Cash on the Sidelines

Never before has there been so much cash sitting on the sidelines, with over $7.4 trillion in savings and money market accounts (see chart below), earning just 3-4% interest. Warren Buffett is sitting on his largest cash hoard ever, at nearly $382 billion.

While the majority of this cash is institutionally held for liquidity and cash-management purposes, it’s estimated that $800 billion, around 10% of the total sidelined funds, may be up for grabs, as that number roughly equates to the cash moved into liquid funds when rates were more attractive.

At a time when the stock market has returned around 15% YTD and gold has exploded at over 50% YTD, what does this cash on the sidelines mean? Is it bullish or bearish? I see three options:

Opportunity knocks, and FOMO kicks in when uncertainty turns to optimism, and the recent market tumble looks like it’s rebounding. This sidelined cash acts as a tailwind for a new rally.

The AI bubble is real; it bursts, and these prudent, patient investors put their money to work by buying the dip.

Nothing. Nothing happens at all. Conservative investors keep their money exactly where it is. BUT, there is still an unprecedented wealth transfer coming. What moves will the inheritors make?

Any of these three scenarios has intriguing implications for the economy. How will the macro forces play out, and what will be the preferred assets of the future? I have my guesses…

Business Landscape

The business sector is also seeing a K-shaped trajectory. Cost-sensitive businesses (especially small businesses) face challenges related to inflation and tariffs, rising healthcare costs, changes in consumer spending, labor shortages, and more. On the other hand, large businesses, especially those in tech, healthcare, and e-commerce, are experiencing capital inflows at an unfathomable scale due to the AI-driven expansion we are experiencing.

We are in the midst of an AI-fueled revolution that will change where people invest their attention, what they consume, and how they live. There is untold, untapped growth for many (I’d even venture to say most) business sectors if they can find a way to get on the AI bandwagon. Companies must use this information to their competitive advantage. And that growth imperative is not lost on the market. IPO, VC, and M&A activity have all evolved in 2025, again, driven by AI.

So far, 2025 has seen 343 IPOs, the 4th-highest year in the last 25 years (see chart below). Experts estimate that around 40% of 2025 IPOs were either core technology providers or companies using AI as a central asset or strategy. My gut feeling is that that percentage would be even higher if you consider public offerings made possible by their support of, or adjacency to, AI. As strong as 2025 has been, 2026 is expected to see even more public offerings as interest rates level off and anticipated exits come to fruition.

Source: [stockanalysis]

VC activity has been strong but more sensitive to economic fluctuations this year. Still, investment surged YoY in Q3 and gained steam over Q2. We saw a shift in dynamics, with fewer deals receiving greater funding, indicating a concentration of resources on larger-scale endeavors, aka megadeals. Again, AI and AI-adjacent sectors are the primary targets of VC investment, while tariff-sensitive industries are seeing a pullback. Exit activity is promising, both via IPOs, as mentioned above, and M&As, lending greater confidence than we might otherwise see in VC activity right now.

The M&A landscape is thriving, driven by (do I even need to say it) AI, as companies seek to acquire both technology and talent to expand their capabilities and market share quickly. Despite geopolitical uncertainty and trade challenges, strong fundamentals, attractive valuations, a lower regulatory environment, and stabilizing interest rates are contributing to an optimistic mood.

Although there is AI bubble chatter, we aren’t far off the starting line in the AI race to change the world, so while risk is present, I agree, at least for now, that: “Typically, rising inflation, higher interest rates, and slower aggregate growth would create a sharp drop in business investment. However, we assume AI-related investment to remain relatively, though not entirely, impervious to these headwinds” [Deloitte]. Similarly to how there was no going back from the industrial revolution, the AI revolution is here to stay, and while elements that could encourage a corrective environment are present, the majority of institutional capital will continue to flow toward the technology that is ushering us into the future of our civilization.

The AI Economy

The entire U.S. economy is being propped up by AI investment, leaving our country in a vulnerable position, especially given the underlying financial strain most Americans are experiencing. A crash or bubble burst would have painful consequences, despite private investors being relatively well-insulated from the opaque financing that has funded much of the existing and planned development. Like bubbles we’ve seen before, it’s the interplay of the infrastructure expenditure and company output vs. valuations that is causing concern:

Large technology firms are projected to spend hundreds of billions of dollars on semiconductors, data centers, and related infrastructure over the next several years, spending that some analysts estimate accounted for nearly half of U.S. GDP growth over the past year. Still, skepticism persists around the sustainability of this investment cycle, given the limited number of commercial AI applications to date. With “hyperscalers” now comprising roughly 40% of the S&P 500 Index’s total value, the index remains highly sensitive to shifts in expectations for AI-driven growth [Mesirow].

Listen, I am 100% in on AI. My entire company is built on a structure that empowers people to transform their work, income, and lives by leveraging the power of AI that we put in their pockets. I don’t just think AI is going to transform the world, I am as sure of it as I am of anything else. I’m not worried about use cases in the medium- to long-term. And, yet…

A crash isn’t necessarily about the medium-to-long term. The dot-com bubble burst didn’t kill the internet. The housing bubble burst didn’t kill real estate. Heck, the world saw railroad and canal bubbles burst during the Industrial Revolution, and that infrastructure still supports shipping logistics today. When an economic revolution is afoot, everyone wants a piece of the pie, and that leads to overproduction, or more accurately, production that moves faster than its debt can carry it. All that data center space will be used, just as all the fiber-optic lines from the dot-com era are now, and just as we have a housing inventory shortage now. It’s not a matter of if, but when. And at what point did you enter the market?

Do I think there is an AI bubble getting ready to burst? I wouldn’t use those words, because there isn’t always language to describe new paradigms. There is a lot that is inherent to AI that hedges risk that previous bubble fodder didn’t have. They say about investing that the four most dangerous words are: “This time it’s different.” Maybe this time it isn’t different, but it is definitely interesting. Anomalous, even. There are plenty of counter-indications to the bubble narrative. I like this one:

What we are witnessing is not a speculative mania but a structural transformation driven by thermodynamics, power density and a global shift toward energy-based intelligence. The bubble narrative persists because many observers are diagnosing this moment with the wrong conceptual tools. They are treating an energy-driven transformation as if it were a software upgrade [Forbes].

If you have time, read Jason Snyder's whole Forbes thinkpiece; it’s fascinating and makes an incredible argument against the bubble narrative and for a paradigm shift in understanding what AI really is and what it represents in our evolution as a species.

I can’t tell you whether there’s an AI bubble, only that talk of one can often trigger correction behavior that can be nearly as painful. As household debt and delinquencies mount, wages and savings slow, and the job market is off balance, we are facing the reality that AI could be overblown.

This is the point I’ve been building to: If (IF!) If AI falters, we will have to face the reality that AI spending may be the only thing preventing the U.S. from falling into a recession – I think that’s the underlying story that is more important than the headline.

So what’s my advice? Well, one of my favorite adages is “Never waste a good crisis.” I know it’s flippant. I know it disregards the real pain people feel during economic upheaval. But if we can’t stop crises from happening, what can we do? We can prepare. That’s it. So, how do we prepare? Well, the aforementioned Warren Buffett has one idea. Michael Burry has another. As I look back at previous bubbles, I’ve gleaned two pieces of wisdom: 1. Make your bets on who the winners of the revolution will be. 2. Train now for the jobs that will exist in the future. If there is a bubble, you might win. If there’s no bubble… we all win.

Looking Forward

At the beginning of this year, I penned this article predicting a crash in the near future. While I’m skeptical of an all-out AI bubble (in fact, I didn’t even mention AI in my earlier prediction), I do still feel that the fundamentals of our economy are ripe for the inevitability of a recession, and our vulnerability to the success or failure of the AI economy only underscores that perspective. People who see no financial benefit from the AI boom in their lives may already be living in recession-like conditions. If there’s a crash, regardless of the origin, it will come for jobs, retirement accounts, businesses, and more. Then, to bring us back to the beginning of this section on the U.S. economy, the fallout would be met with stimulus in the form of lower rates (in which case we’ll be thanking the powers that be for the high rates of 2022-current) and any number of other measures that would add further to the national debt. It would also have consequences for trade and geopolitical tensions. There are no easy fixes; the cycles continue.

Still, I believe in silver linings. There is no crash-proof economy. No pain, no gain. Recessions are necessary, and honestly? We stand to benefit from one right now. What’s the fastest route to sustainably improving affordability on everyday goods and services? What could spawn innovation and increase productivity? How can younger generations get a foothold in wealth creation? A recession is the answer to all of these questions. More bright side takes? Home equity is solid; I don’t see any risk of a housing crisis, which will preserve wealth for homeowners in a downturn. That record-breaking cash on the sidelines (i.e., wealth) and those safe-haven assets that are soaring are also hedges in a recession. AI is creating new jobs and job types as we speak, while skilled trades with great pay are short on workers, and their projects are growing in scale. Recessions are a great time to change career paths. Recessions also tend to mint new entrepreneurs and disruptors (Amazon, Uber, the telephone). I won’t dismiss the fact that recessions cost some people everything, but I also refuse to ignore that recessions spawn progress. As someone who began my career in real estate at the start of one recession (on the day Lehman Brothers filed BK in 2008), and then started my company during another (in the depths of a global pandemic), I intend to stay focused on progress. What will you do?

One Year of Trump 2.0 —

Real Estate Impacts

It’s been over a year since we learned that a reboot of President Trump’s administration would take the White House, and nearly a full year since his inauguration. A year ago today, the real estate market was still effectively frozen, and the Trump campaign had a lot to say about how they would address that issue. In my annual letter last year, I addressed the top six campaign promises I believed would affect the housing market and made some predictions. Now, twelve months in, how did my predictions fare, and what is on the horizon where policy meets impact, now?:

What I Predicted & What Happened

1. Tax Policy

With the passage of the One Big Beautiful Bill Act (OBBBA) over the summer, key provisions from the 2017 Tax Cuts and Jobs Act for businesses and individuals were made permanent, and new provisions were added, including increases in SALT deductions, tax benefits for seniors, and exemptions for tips and overtime pay. While the continuation of this tax policy is no surprise (and is in line with what I predicted), there are welcome and notable wins, especially for luxury real estate, investors, and developers. That being said, as I mentioned in last year’s letter, the bill and the tax cuts specifically also add trillions to the national deficit and are therefore inflationary. When OBBBA passed, the stock market reacted positively, while bond yields rose, pushing mortgage rates higher; a loss for more rate-sensitive sectors of the real estate market.

2. Reduced Building Regulations

While some progress has been made in reducing building regulations for both residential and commercial construction projects, as I predicted, the reality is that the majority of the decision-making on that front is in the hands of state and local governments. Unfortunately, the areas most impacted by housing shortages are also the least likely to adopt lower regulatory provisions to stimulate construction. The Administration has successfully cut red tape for federal environmental requirements for new projects; however, experts have warned of increased exposure to climate disasters resulting from these policies. I’ve written more extensively about this in a previous letter, but climate disasters with billion-dollar financial tolls are sharply on the rise and are a grave risk to American real estate. We would be wise to insulate ourselves from the impacts of those disasters in every way possible, without hampering our growth.

An executive order was issued to modernize trade training programs, but no specific, coordinated action to that end has been outlined or is underway. There’s also an issue of circular logic related to the feasibility of this plan, as well as to wages and the price of goods inherent in a plan that seeks to fill the hole left by immigrant workers with U.S. citizens.

The American economy is currently reliant on immigration, both legal and otherwise. If it can adjust to a lower-immigration normal (and that’s a big if), that path has not yet become clear.

5. Tariffs on Imported Goods

While tariffs have been implemented on a scale not seen since the 1930s, and some impacts have materialized, we as a nation are still flying blind about where we’ll end up on the tariff front. Are the tariffs legal? We don’t know. Where will the revenue from the tariffs go if they are legal? We don’t know. Will they generate a net gain? Don’t know. Will they be inflationary in the long run? You see where this is going…

As for now, tariffs have proven to be slightly inflationary (and could be more so the longer they last) and have led to higher construction costs, further restricting the construction of residential homes needed to ease the housing affordability crisis (And yes, I called it). The tariffs have also served in part to restrict the job market. The struggling job market actually has a slightly positive impact on the real estate market, as it gives the Fed a path to lower rates despite sticky inflation, although lower inflation would have provided that path in a manner healthier for the economy overall.

6. Mortgage Rates

Mortgage rates have improved this year, but I’m not sure much of that can be attributed to the current administration. This should be no surprise, as I mentioned in my letter last year, the president has minimal control over mortgage interest rates. That’s not keeping him from trying to exert force to lower them, though. The president continues to pressure the Fed to cut rates, despite its requisite independence from politics. Thus far, it seems the Fed remains impervious to his pressure, but the current Fed Chair’s term is about to end, and a new one will be appointed by a president intent on influencing Fed policy. Much could change at that point.

That said, the Fed does not directly determine mortgage rates either. Their rate decision does have an indirect correlation with mortgage rates, but that could change. Mortgage rates are closely aligned with 10-year Treasury yields, so if investors demand higher yields for a litany of reasons, including eroding confidence in the Fed's ability to influence the U.S. economy, mortgage rates could begin to behave in unexpected ways. I will be watching to see how this situation evolves.

——

At the end of last year, I predicted improvement in the 2025 market over 2023 & 2024 as the economy shook off stagnant energy and got a shot of fresh juice. It has - inventory is looser, rates are lower, and while net sales have not picked up a ton yet, affordability is improving - but wages and inflation, elements the president does have influence over, will need to play nice to keep that trajectory headed in the right direction.

Trump’s Housing Impact 2026 & Beyond

President Trump campaigned on affordability, and no shortage of actions by his administration have aimed to impact real estate and the cost of housing. Here’s an exhaustive list, if you have the time and patience to review it. The impact, or more accurately, the anticipated impact, is mixed, but as they say, nothing is 100%. I like the tax plan and the provisions for affordable housing. I am hopeful for a decline in mortgage rates, but given inflationary trends, I am alert about what the broader economy will need to endure to achieve them. Recently, the White House has been floating some new ideas to improve affordability for homebuyers. One is the 50-year mortgage. Another is the portable mortgage. Both have substantial flaws and implementation barriers. Still, I’m happy to see a highly targeted effort in Washington to explore options that would make homeownership and mobility accessible to the millions of Americans who are stuck on the fence or locked in place in their current homes.

3. Building on Federal Land

It appears that this proposal is still in the ideation phase. As I mentioned last year, there is a cap on the efficacy of this concept, as I understand it, because so little federal land is available for this purpose, and it is primarily rural and outside areas where people can make a living. No news on this front.

4. Deportation Effort

I predicted that mass deportations wouldn’t come to fruition due to adverse economic risks. While the scale of actual deportations is highly debatable, wide-scale operations have indeed taken place. Both rhetoric and methods used in those operations have had a tangible impact on the immigrant population, including a decrease in immigrant inflows for the first time since the 1960s, and a reduction of workers, especially in states with higher undocumented worker populations. The impact has trickled into housing, and is poised to increase over time. In places like Houston, the effect on housing serves as a model of what we hope to avoid on a larger scale nationwide.

Wherever you stand on this issue, the thing we must address as a nation is the hugely detrimental impact of population decline. The birth rate in the U.S. fell to an all-time low this year. Even if the birth rate began to rise now, the U.S. can’t wait 20+ years for those babies to grow up, get educated, and become skilled workers to replace those we’re losing via immigration.

92% of construction firms report having difficulty finding workers, and 45% say labor shortages are causing project delays. Furthermore, as reported by NPR:

[Subcontractor] jobs are desperately needed in the home-building industry, where the ongoing shortage of workers costs $11 billion annually, the Home Building Institute (HBI) estimates. In the U.S., the gap between supply and demand in the housing market is roughly 1.5 million housing units, NAHB says [NPR].

This begs the questions: Who is going to do the work, and at what price? The issue isn’t simply an unwillingness of U.S. citizens to take these jobs; there’s also a huge skills gap, thanks in part to the rise of academic degrees over trades and the devolution of unions and the benefits that come with them.

Housing Market Update

U.S. Housing Market

At the national level, home price appreciation has stabilized from the rapid (and unhealthy) YoY rises we saw in 2020-2022, offering homeowners modest but consistent gains on average. Inventory levels of homes for sale have increased, and while they have yet to reach pre-pandemic levels, months of supply are now at a level that offers buyers and sellers greater equality in the negotiation process. And although homebuyer demand is still weak (for now) amid broader economic uncertainty, that fact is helping along affordability for those in the market to buy a home, since wild competition and bidding wars are no longer a challenge in most areas.

National averages only tell part of the story, though. As I noted last year, regionality in the real estate market has returned. COVID wiped out this regional differentiation to a large extent, as inventory plummeted and home prices skyrocketed across the map. Now, the South and West are leading in inventory gains and seeing mild home price depreciation in select areas, while the Northeast and Midwest still have more restricted inventory and rising home prices, with those increases being more pronounced in the most in-demand areas. This return to sanity, where local factors appropriately influence regional markets, is a win for the real estate market and consumers.

Assuming these trends continue, the factors most likely to influence the housing market in the coming year are mortgage rates, employment, and wages. As it currently stands, the majority of homeowners have rates in the 3-4% range, but one-fifth of homeowners have rates below 3%, which is nearly impossible to justify giving up, so the lock-in effect is still in play for the lowest rate holders. Nearly the same share of homeowners have rates greater than or equal to 6% (see figures below), preventing them from experiencing the lock-in effect. Still, those homeowners would have purchased their homes in the last 2-3 years, giving them many upcoming years in their homes before they’re ready to move, according to current turnover rates.

[National Mortgage Professional]

The lock-in effect has certainly eased, and that accounts for a portion of the increased inventory. To some extent, it’s been about people finding today’s rates more tolerable, but it’s also about the massive amount of equity they’ve accrued and the money they’ve been able to save due to enjoying low monthly payments. Inflation has also played a key role; never forget that when you lock in the price you pay for a home, inflation chips away at the value of each of the dollars you invested, meaning that even without appreciation, you secured a better deal than someone who bought, even for the same price, several years of inflation later. Home sellers today have experienced expedited equity gain thanks to the high inflation of the last several years.

Those factors don’t account for all of the inventory gains, though. Many homeowners simply couldn’t wait any longer to move, as life circumstances (jobs, marriage, babies, health) change regardless of rates. Heirs don’t usually want to move into the family home. Local factors such as skyrocketing insurance costs, overbuilding, a softening short-term rental market, and decreased employment have also played a role in the national averages. Inventory growth has been compounded by weak demand.

I believe rates in the 5% range are the psychological threshold for resetting the collective mindset about rates at scale and leaving the lock-in effect behind. While mortgage rates have improved significantly over the last year, continued near-term improvement will be challenged by gloomy expectations for the national debt, inflation, and other economic uncertainties, forcing both the fed funds rate and treasury bond yields higher than we’d need to see mortgage rates fall below 6%. Presently, most lenders and forecasters anticipate rates in the 6% range through 2027, though I do think there are arguments for faster improvement.

As for the dismal sales volume of the last few years, 2025 improved marginally over 2023 and 2024, but remained categorically low compared to normal sales volume over the last several decades. In fact, population-adjusted, the last three years may have been the slowest years for home sales ever. Now, it looks as though mortgage rates and home prices are stabilizing and we shouldn’t expect large swings in either direction, barring a black swan event. All else being equal, that leaves wage growth and the job market as our potential sources of demand stimulation, neither of which is thriving at the moment. If these issues even just begin to tilt toward improvement, the positive snowball effect on the housing market will be huge.

For in-depth reports on our New York City and Signature markets, click here.

Luxury Market

The luxury market is a completely different ballgame, now more than ever. There are two primary factors contributing to this fact. One is that the luxury market is not rate-sensitive: about half of homes priced between $2 million and $5 million, and over 65% of properties priced between $5 million and $10 million, were cash transactions so far this year [Realtor.com]. The second is the three-year bull market, which has been compounding wealth for investors who view U.S. real estate as a safe-haven asset.

Despite some dissenting opinions, I expect volatility in the stock market to fuel this trend further, as high-net-worth investors reallocate their portfolios into safe havens such as real estate. Another tailwind for the luxury market is the unprecedented wealth transfer underway from boomers to younger generations. However, it’s less the ‘silver tsunami’ we’ve read about for years, and more a trickle. While the West and the Northeast will continue to see the majority of luxury transactions, the Southeast is exploding in the luxury sector thanks to tax advantages and attractive weather. Some traditional luxury markets, such as those in California and Florida, are also among the highest in climate risks and insurance costs; for that reason, we are seeing luxury demand increase in alternative markets that offer trade-offs, such as acreage and local amenities [Mordor]. This dynamic leads to varying conditions across markets, as some areas see market times and inventory tick up, while others remain as competitive as ever.

A Note on the NYC Market In The New Age of Mamdani

As the CEO of a brokerage founded in NYC, I’d be remiss not to address this:

There’s a new Mayor in town in New York City, and the city is deeply divided when it comes to the impact he could have on the real estate market. Mayor-elect Zohran Mamdani is centering his housing and real estate agenda on an aggressive pro-tenant, pro-building platform: he has pledged a multi‑year freeze on rents for roughly 1–2 million rent‑stabilized tenants, while simultaneously committing about $100 billion over 10 years to construct roughly 200,000 new publicly subsidized, permanently affordable, largely union‑built homes and to double capital spending to preserve existing public housing stock. His program frames housing as a public good rather than a speculative asset (investors don’t love this framing), calling for tripling city‑funded affordable production, expanding voucher-backed leasing and development tools, and removing city-imposed barriers to new construction, including eliminating parking minimums and increasing density around transit to unlock more multifamily supply. Politically, he positions this as “all of the above” tenant protection plus supply growth, in open conflict with much of the traditional landlord and real estate lobby, which warns the rent freeze could strain small owners, depress investment, and complicate financing for new private projects. Detractors insist Mamdani’s agenda is going to send New York’s wealthy residents and even ordinary homeowners fleeing for the hills.

New York City's luxury market had its best month in years in October, right before the mayoral election, suggesting that no exodus was underway despite the overwhelming odds of the Mamdani victory that did in fact transpire. That demonstrates that, while there was an initial reaction period, the expectation of impacts on the housing market was already baked in, socialized, and digested by the market and had already settled. Are the political concerns of wealthy NYC residents well-founded? To some extent. Townhome owners in particular are atwitter about another proposal of his – reducing police presence. Landlords certainly have cause for concern. Is there chatter about those wealthy residents relocating? Yes. Do suburban New York and Florida agents say they’re seeing a surge in New York ‘Mamdani refugees’? Also yes. Have we seen real results? Not in our firm, and not when we speak with other industry professionals.

The fact remains that New York City is bigger than any one person. It’s a top-tier, first-class destination that commands real estate demand from around the world. Only a small handful of other cities around the globe even come close to the Big Apple’s grandeur and commercial importance. The idea that an elected local official could, at scale, damage the residential and corporate demand dynamics of a cultural and business hub such as New York is, frankly, preposterous. New Yorkers were resilient in the face of the 2008 housing crash, Superstorm Sandy, and a global pandemic. Besides, New Yorkers can’t live anywhere else; when we leave, we just survive it. There’s only one place we actually belong.

Futurecasting for 2026 & Beyond

My prediction is that the real estate market is about to get a LOT busier. There isn’t one single factor I can point to that will drive this improvement; rather, several factors are seeing incremental improvement that will add up to big change. These factors include:

Continued inventory gains as the lock-in effect eases.

A generationally top-heavy population makeup and slowing population growth chipping away at competition and contributing further to inventory gains.

Moderate home price growth stabilizing affordability concerns without tapping homeowners’ equity wealth.

Slowly falling mortgage interest rates stimulating demand.

Increased consumer choice related to agent fees decreasing home purchase-related costs for lower-income buyers.

Favorable tax incentives for homeownership and investors aiding affordability.

A governmental focus on cost of living improvements stretching household budgets further (maybe wishful thinking, but would be politically advantageous to anyone seeking power).

Progress on inflation (also maybe wishful thinking) as it appears the Fed will maintain a higher for longer stance on rates.

My hope is that the job market and wages will also improve in the coming months and years. If not, we will likely fall into recession territory (which, as I mentioned earlier, wouldn’t be the worst outcome). Recessions can be a boon to the housing market because they are typically met with stimulus efforts like rate improvements, tax rebates, and direct payments to consumers, including homebuyer incentive programs. Recessions also tend to increase housing turnover and migration patterns, both of which would present a marked change in the housing market from the last few years.

Because I said the word ‘recession,’ I want to take a moment to quell the fears of anyone for whom that word conjures up images of the housing crisis of 2008. In 2019, mortgage delinquencies had achieved record lows as a result of mortgage industry reforms following the subprime mortgage crisis. Then, in 2020, when the pandemic hit, a moratorium on foreclosure activity was put in place, and the market has only recently begun to normalize as those foreclosures that were in the moratorium aged out. Now, mortgage delinquencies and foreclosure activity have risen but remain near all-time lows, as home equity has ballooned over the last 5 years, and modern mortgage borrowers are among the most well-qualified in all of history, thanks to the aforementioned mortgage industry reforms. That means the majority of homeowners are safe from short sales and foreclosures, barring those in extremely depressed areas and those with the highest exposure to natural disasters. While homeowners in certain areas (mainly the South) who purchased recently and used low down-payment mortgages may find their property values dip slightly underwater, even they should be relatively well-prepared to hold tight in a downturn given the strength of their borrower profile. Those that do face foreclosure are not on a large enough scale to harm the housing market.

In short? There is no housing crash coming.

Instead, influences that may be net negatives for the macroeconomic landscape will conversely impact the real estate market positively. We will see a rebound in sales activity, while home prices remain stable (happy homeowners) and affordability improves (happy homebuyers). Simultaneously, the real estate industry is at an inflection point, compounded by the advent of the AI revolution, which will force innovation that should improve the process of transferring real property by leaps and bounds, improving the consumer experience, and modernizing an industry that has, until recently, been controlled by the inefficiencies of an old guard. And who else but SERHANT. will be leading the way on that endeavor?

Real Estate Industry Update

Market Consolidation

In September of this year, Compass bought the holding company Anywhere, which owned the brokerages Corcoran, Sotheby's, Century 21, Coldwell Banker, ERA, and Better Homes & Gardens, in an all-stock transaction valued at $1.6 billion, while assuming about $2.6 billion in debt. This summer, Redfin was acquired by Rocket Companies. And those are just two of the headline real estate mergers & acquisitions in the last few years. This is what happens in mature industries.

“When innovation slows, consolidation grows.” - Me

I’m not saying consolidation is a bad goal at the corporate level. In this case, though, when the goal is to increase revenue for the company (not necessarily the consumer or the agent) in a marketplace that cannot impact macro market-dependent transaction volume, then two of the primary objectives seem to be:

Scale. More dealmakers. But dealmakers are expensive. Does it cost less to retain more dealmakers and allow them to operate at a lower quality, or to train fewer dealmakers to take market share from lower quality dealmakers?

Revenue sources. What else do we have that we can monetize?

In my opinion, these two questions introduce a slippery slope in the real estate industry. A core tenet of what I believe to be true about the real estate business, and one I center in SERHANT.’s growth, is that our clients choose to work with the agent, not the brokerage. And if that’s true, agents choose a brokerage based on whether it can serve them in ways that help them to better serve their clients.

In real estate, our product is people, or more aptly, the service we provide them and the relationships we share with them. I question whether the scale created by these mergers will lead to innovation that delivers better outcomes for the people our industry serves. As it stands, the top 10% of brokerages handle 40-50% of all real estate transactions. That’s fine if those brokerages’ practices are consumer-friendly. Isn’t that the problem with corporate market share, though?

When scale is the headline in these consolidation deals, what is the benefit to the agent or their clients? I would argue that the emphasis in these mergers is more on the value of the data and the capital that can be controlled, rather than on objectives that benefit the actual people involved. This is an interesting choice that says a lot about the future goals of these brokerages corporations. That brings me to my next point about the industry…

Data Wars

Now that commission lawsuits, which settled last year, are behind us, the next frontier in the real estate industry’s infighting is who controls the data on property listings. Buckle up, this one is messy.

Currently, when a broker takes a listing, they control the data about that listing, until they upload that data to their local multiple listing service MLS. The MLS portals are almost always governed by rules set by the primary real estate trade organization, the National Association of Realtors (NAR). Real estate agents and brokers must be NAR members to access most MLS portals. One of the key features of an MLS portal is its internet data exchange (IDX) capabilities, which share data about listings to syndicated sites. Those sites include consumer portals like Zillow and Realtor.com, and brokerage websites like Redfin, Compass, and any other brokerage sites that have an IDX plugin installed. This syndication makes MLS data (which only real estate professionals can access) available to the public. Syndication has been a lucrative mechanism, especially for Zillow.

So, NAR controls most MLSs’ rules and access through a network of local associations that own or collaborate with MLS providers. About 75% of real estate agents are NAR members, and only NAR members can access most MLSs. The most hotly contested MLS rule set by NAR is Clear Cooperation, which requires that all members’ property listings data be entered into the local MLS within one business day of any public marketing of that property. Supporters argue that Clear Cooperation democratizes access to data for homebuyers and that maximum exposure yields the highest price for home sellers. Detractors (including the DOJ in antitrust investigations) argue that this limits consumer choice and stifles competition amongst brokers. Other detractors argue that NAR has a monopoly over data via MLS portals, preventing other off-MLS marketplaces from competing for data and the ability to market it.

NAR has proposed and implemented modifications to Clear Cooperation that allow sellers to delay marketing through syndication and off-MLS office-exclusive listings (within a single brokerage only) for a period of time. Still, some feel this doesn’t go far enough to allow sellers to choose “pocket listing” strategies that are private and off-record, and agents to leverage the data of those listings to gain a competitive advantage.

On the flip side, some argue that MLS rules are actually pro-competitive, preventing megabrokerages and megaagents from gobbling up market share through data access and allowing smaller brokerages and agents to preserve their customer relationships by offering democratized access to the data they need to make purchasing decisions. So, there’s the question of whether MLSs should have ownership of data, or the power over the rules that govern how the data is used…

Then, there’s the issue of NAR and MLSs allowing syndication of that data to portals that monetize it. Zillow dominates consumer traffic in many markets because of its layered data (Zestimates, Climate Scores, etc.) and extensive investment in UX. It monetizes its data by selling ad space and consumer inquiries (leads) back to the agents who originated the data. This creates resentment amongst agents and obvious concerns about erosion of control. Realtor.com operates similarly, as does Redfin. Redfin differs somewhat in that it operates as a brokerage and sells its inquiries and referrals to its own agents and referral partners through increased commission splits. It seems clear that forcing brokerages to share the data publicly stifles their right to compete with other brokerages for market share via their relationships. Many have also invested in their own tech infrastructure to attract consumer traffic and turn that traffic into leads for their own agents, but clear cooperation forces them to share their data with the very entities they deem their competition in these data wars.

Now, AI enters the scene. With website traffic down and AI large language model (LLM) inquiries up, SEO and ad budgets are becoming increasingly obsolete, as consumers migrate to AI for their data access and information. MLS IDX syndication didn’t plan for this. Where do those LLMs get access to the data? There have also long been companies that seek to monetize data by aggregating it and using algorithms to predict valations, risk, and turnover, a trend amplified by the rising prevalence of AI startups.

Reminder: the data that generates revenue for these companies comes from individual agents (real people) through their relationships with individual homeowners (other real people, who’s homes are the data). So who should own the data, and who should be able to monetize it?

Compass and other brokerages argue that the property listings and client relationships originated with their agents and are therefore the brokerages’ to own. Compass, especially, has taken up this fight, currently offering its non-compulsory “3-Phase Marketing Plan” to all sellers, a plan that includes a marketing phase that withholds the listing data from the MLS for broader market consumption while the listing is shared as a “Private Exclusive” within Compass’ agent referral network. While this technically complies with NAR’s modified Clear Cooperation policy, it’s also a clear declaration of disruption from NAR’s clutches. Compass has fought local MLSs and NAR in court vehemently on this point, arguing that in fact, the open market (currently defined as data entry into the MLS) does not always fetch a homeowner the best price, given that MLS rules force homeowners into public scrutiny of their home and marketing strategy irreversibly, including publication of price reductions and tally of the days on market, which can weaken a seller’s negotiation position. Now, thanks to their recent acquisition of Anywhere, Compass is the largest real estate brokerage in the world by sales volume, a formidable adversary for NAR.

This all sounds a bit like Mobland, doesn't it?

Here’s where I stand on the issue: Two things can be true at the same time. I absolutely think that NAR’s practices are anti-competitive and stifle innovation that could benefit consumers. I also feel that exposure to the open market yields homeowners the highest and best price for their homes when they sell, but I take issue with how we currently define “The Open Market” (i.e., MLS listings). The way I’m thinking about it, the solution revolves around the concept of innovation in pursuit of the consumer's best interest. What are the particles of that?

Shifting the Industry Focus to PEOPLE

In the current system, NAR and the MLS effectively control property listing data. They sell access to that data through IDX subscriptions, and IDX syndicators then monetize the data they purchase. As a result, brokerages must buy back access to the very data they created to use it for their own business. Consumers ultimately benefit the least: the data being sold is about their homes, yet it’s packaged, resold, and then folded into the fees brokerages and agents pay — costs that are eventually passed down to clients through higher fees.

So if the consumer chooses to hand their data over to someone, what do they want in exchange? I would argue that they want, first and foremost, choice and agency to set their goals and determine how they’re met. For example, the open market may be best for certain homeowners in achieving the highest and best price for their property, but for others, privacy may be tantamount to returns. Once their need for agency is satisfied, consumers want simplicity. Home sales are complicated, emotional, and full of headaches. Winning a customer means offering them the solution to their problems and it’s agents and should be their brokerages that do that. To offer someone agency and simplicity, you have to earn their trust. And THAT is why real estate is a relationships business, not a data business.

If we accept these truths, then what is the brokerages’ role in the marketplace? What does a brokerage owe to an agent, and what do they owe to a consumer? I believe SERHANT. is the living, breathing answer to those questions, so I won’t bother to answer them in detail here. What I will say is that I also believe that the answer to these questions will separate the winners from the losers in the pursuit of ‘Brokerage 3.0’ and beyond. Will NAR survive? Will new trade organizations take their place? What will come of Zillow (which is in a lot of legal turmoil I didn’t even touch on) and the data aggregators? The answer lies in their ability to be malleable in their efforts to support the goals of the consumer, the agent, and the brokerage as they shift and evolve, without selling out on those imperatives in the name of corporate profit. In short, those who put people first will win.

SERHANT. Business Update

As we wrap up our fifth year in business, I am beyond proud of the heights we’ve reached. It’s not just about our revenue or our innovation accomplishments, but the lives we’ve transformed and the standards we’ve set industry-wide. 5-years-ago Ryan had all of the vision and confidence in the world that he was building something entirely different in SERHANT., but even he could not have imagined where we are today. I have proof he didn’t, in fact. (Man, that fortune teller looks SO familiar!)

We make an offer that can’t be refused: we give agents a path to earn more, reclaim their time, and live bigger lives. When our agents deploy our tools, they refine their craft and deliver extraordinary results, making their clients’ goals a reality.

What are those tools? STUDIOS powers personal branding and content dominance. Sell It hones skills and drives performance. Signature elevates luxury service to the stratosphere. ID Lab gives every agent and our signature listings a distinct identity that cuts through a crowded market. New Development opens doors that no other firm can. S.MPLE removes administrative drag so agents can focus on what they do best. Every piece of this ecosystem is designed to maximize reach, impact, and results, and the net effect is unbeatable.

Reach is power, and SERHANT. dominates in that regard. In a world moving past SEO, SEM, and website traffic, SERHANT. commands attention where it counts: social, AI-driven channels, and real human connections. We are the most-followed real estate brokerage on the planet, with 9.3 million followers across platforms and over 40 billion PR impressions from more than 1,400 placements YTD. That reach creates value when visibility can no longer be taken for granted.

There’s a promise we make that is implied in every handshake we share with the agents and clients we partner with. That promise is that they have a partner with a singular focus on empowering their success in a rapidly changing industry. The old guard is dying off, trading profit for people and getting dusted by AI’s rapid rise to tech domination, but SERHANT. is a pioneer in the next frontier of our industry, and our first-mover advantage is your leverage in this new marketplace. They can’t beat us, so you might as well join us.

Brokerage

2025 was the year that SERHANT. went national! We are no longer just an East Coast powerhouse, as this year we expanded West into Arizona and Nevada. Our national expansion also included Virginia, Maryland, Washington DC, and Rhode Island (the 13th state in the union and for SERHANT.!). That is SIX new states in a single year.

We’re all about ‘Expansion with Ease.’ After two years of testing and incubating, we now have a winning formula that allows us to move into different markets quickly and efficiently. Part of our success lies in knowing our agents better than anyone else. We study our agents' personalities, priorities, and communication styles in depth, and leverage that familiarity to craft customized onboarding programs that practically guarantee success. In other words, we make it feel natural and simple (you know I love that word) for our agents to work within the SERHANT. ecosystem.

The payoff has been undeniable. We’ve surpassed $6 billion in onboarded volume over the last 12 months by hiring less agents than originally budgeted. We’ve found that with S.MPLE, we could exceed our revenue targets with fewer, exceptionally high-quality agents. For instance, the average production level of a SERHANT. agent is approximately 17% higher than all of our competitors. Recruitment has not been a struggle. On the day the Compass/Anywhere deal was announced alone, we received 467 inquiries from agents looking to make a move to SERHANT. Focusing on quality over quantity and vetting our agents for compatibility with our methods is our biggest challenge, and the biggest differentiator from our competitors.

Our strategy continues to earn meaningful recognition across the industry, underscoring the momentum and impact of our work. This year, our team has been celebrated across multiple top-tier platforms, including being ranked the #6 NYC brokerage by The Real Deal. Inman also acknowledged our leadership with several distinctions — from Golden Club finalist for Best City Sale to honors in the Inman Innovator Awards for Most Innovative Brokerage and the Inman AI Awards for Most Innovative Use of AI. Additional accolades include HousingWire’s Tech Trendsetters spotlight on Kelsey Lee, our director of S.MPLE, and its Women of Influence recognition for our Chief Business Officer, Jennifer Alese. The Hollywood Reporter and Variety further highlighted the strength of our team, honoring Kayla Lee, Peter Zaitzeff, and me among the industry’s top agents. I was also featured on Commercial Observer’s first-ever Power 100 Residential and was named an Industry Visionary by Inman.

Our success in expansion is thanks to our people-first mentality that emphasizes personal branding, tech-enabled amplification and simplification, and an interconnected community culture across all of our markets. We spotlight and scale our agents’ brands with a focus on both their future and the future of the industry. We designed a platform around content, community, code, and commerce so agents can grow their brands and remove their busywork to serve clients better and do what they do best: sell.

This positions us as the alternative to legacy brands and large brokerages that have left agents behind, both in terms of exclusivity and technology, as they lose sight of culture and investment in pursuit of greater profit margins. SERHANT. has proven that we can do both: invest in our people and see incredible returns. We’ve learned that luxury isn’t about being the biggest. Brokerages that are ranked higher on RealTrends than we are at #6 have much higher agent headcounts.

Moving into 2026, we will maintain our spark and energy, while pursuing audacious growth goals and doubling our market count. We are strategically moving into all of the top-tier markets across the U.S., and as we do, we are demonstrating that it’s time for our industry to evolve radically. What does that evolution look like, you ask? Just watch and learn.

Signature

Our luxury platform exploded this year. Signature now spans all markets and includes the top 1 percent of listings in each of our markets (typically over $10M), resulting in 156 signature listings YTD. In addition to these changes, we’ve also created a customized and tailored Signature branding package for commercial properties. The Signature branding treatment defines the unique identity of each listing we touch, helping them stand out amongst the pack and attracting not just more eyes on the property, but specifically the right potential buyers.

The results speak for themselves:

150 Charles Street broke the record for the most expensive condo ever sold in downtown Manhattan at $60M.

We represented two of the top nine transactions in all of South Florida

We listed the “Atlanta White House,” a ¾-scale replica of 1600 Pennsylvania avenue complete with an Oval Office and a Lincoln Bedroom, for $35 million.

The sprawling Hamptons estate at 21 & 406 Fairfield Pond Lane came to market at $89 million, a generational opportunity rarely seen, offering a 200 feet of direct ocean frontage and a nine-hole golf course.

543 Stanwich Road in Greenwich, known as "Le Plaisance," sold for one of the top-5 highest prices in Greenwich this year.

We brought the locally-infamous 1045 Waverly Rd. in PA to market for just under $8 million.

New Development

Our New Dev department grew 200% YoY, and remains a cornerstone of SERHANT., scaling into new markets and giving lead brokers a set of offerings that can propel opportunity and market share. Over our relatively short lifespan as a brand, we have systematically expanded our expertise to manage clientele across product type, asset class, and development style, tailoring our approach to each developer and project, offering a level of customization and sophistication to our services that is rarely seen elsewhere. Our ability to thrive at the pace we do across a varied geographical footprint, and roll projects out in a nearly simultaneous manner, sets us apart from any other brokerage in the game.

We’ve accomplished this by delivering true institutional-grade service with a white-glove, soup-to-nuts approach, backed by global reach and a modern marketing machine. That combination doesn’t just set us apart; it attracts icons. It’s why we’ve built strong partnerships with Aston Martin, Mercedes-Benz, global luxury hospitality brand Ritz Carlton, and other powerhouse partners who demand nothing less than exceptional.

ID Lab

ID Lab, our in-house creative production studio, is integral to the SERHANT. universe, crafting our brand, and that of our agents and properties. As SERHANT.’s growth has exploded, ID Lab has been laser-focused on crafting agents’ personal brand identities while bringing our Signature, New Development, and Commercial properties to life, all in the name of differentiation in a crowded marketplace. To meet the moment and meet our agents' needs, ID Lab has just announced a new set of branding packages, including: the Foundations package, which helps agents leverage the SERHANT. brand; the Icon package, offering elevated customization, and the bespoke Legacy package, which includes full creative content support.

To fuel SERHANT.’s expansion as our agent headcount and deal volume grow, ID Lab has added seven new hires and will continue to staff up in the new year. Coming soon: expanded marketing strategy offerings to bring our agents’ content ideas to life, and a Commercial package tailored to meet the unique demands of our commercial listings.

Tech Department/ADX Team/Cyber Infrastructure

Tech is at the heart of everything SERHANT. does, and to say our tech department is different from any other on the planet is an understatement. There is so much that sets us apart from other tech-enabled companies, but the single defining factor is simple: our tech is entirely human-centered. Our VP of Engineering has a physical product design background. Our former CTO is now our Chief Experience Officer, and has the highest level EQ of anyone I’ve ever met. Most “tech people” seek to tech-up the people in their organizations. At SERHANT., we do the opposite. We believe technology should meet people where they are and shape itself to be exactly what they need. Beyond that, we get our agents OFF of screens and back into the real world. How many tech departments aim to do that?

We accomplish this by equipping our support teams with custom AI solutions that exponentially collapse the time it takes to deliver exactly what agents need, without requiring them to learn a new tool or master AI prompt engineering. We automate the repeatable, and human the exceptional. The results speak for themselves: a 99% GCI retention rate in Q3, an industry unmatched NPS score of 87, and national press like this.

Among our tech team’s accomplishments this year are the launch of S.ENTRAL API, a centralized service for all agent data across the entire brokerage, enabling same day payments, rapid onboarding, increased visibility for agent production, and a more seamless experience for agents every day. Extending our mission of leveraging AI to center our people, we delivered an AI-powered CRM for the growth team to arm them with AI-driven personality insights, helping to customize first conversation reports, and other custom integrations to keep them at the top of the recruiting game. The AI-driven hospitality reaches into every part of SERHANT.’s business model, including our newly-launched and custom-built advisor dashboard software which supercharges our advisor team with customized AI capabilities, new automations, new recipes and ways to get agents customized offerings quickly.

Our most notable accomplishments, however, continue to revolve around our proprietary AI platform, S.MPLE, which has seen massive growth with nearly 12,000 individual requests this year alone. S.MPLE landed in the public app store for broad use in April. The app store launch aided in the user growth of over 70%. Our agents are eager to adopt this tool as quickly as possible once they onboard because it removes administrative friction and allows them to focus on selling. But believe me when I tell you, you can’t imagine what S.MPLE will be able to do a year from now; the next iteration of S.MPLE will blow minds. Our CXO, Ryan Coyne, hinted at some of the functionality we’re building here. We’ve beta-tested this functionality with a select group of our agents who have seen an average 144% GCI uplift. Put simply: we’re putting unprecedented power in the pockets of our agents, helping them to do less of what they hate, more of what they are uniquely qualified to do, and doing it better than ever before. Imagine what the industry will look like when every SERHANT. agent has this level of advantage. We’re about to find out…

Studios